The LTV Playbook

After years of exponential growth, our eCommerce journey hit a wall. No matter how hard we pushed, growth seemed harder to achieve with each passing month. It took me years to uncover the real drivers of sustainable growth—this story will change the way you look at your brand forever.

We tried countless marketing twists, each bringing brief success, fading out as soon as the new concept wore out. It felt like an endless cycle of chasing short-lived wins. After months of trial and error, we had a breakthrough—one that changed everything. Fast forward five years, and we’ve scaled our Shopify store to over $100 million in revenue and $30 million profit.

This is the story of how we did it—and how you can, too.

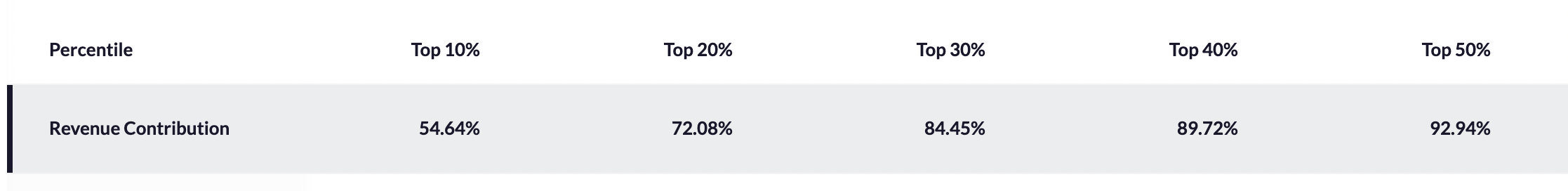

Budgets were tight, quick results were demanded, yet we knew deep down that customer quality was the key to long-term success. Our numbers told the story: 72% of our revenue came from just 20% of our customers.

To fuel short-term growth we launched aggressive customer acquisition campaigns, resulting in low-quality customers. Pressure from high inventory levels compounded the problem. Although we had it on our agenda, many internal stakeholders pushed back, arguing that we couldn’t afford to focus on customer quality. Instead, we needed to sell fast, clear out inventory, and build up cash reserves.

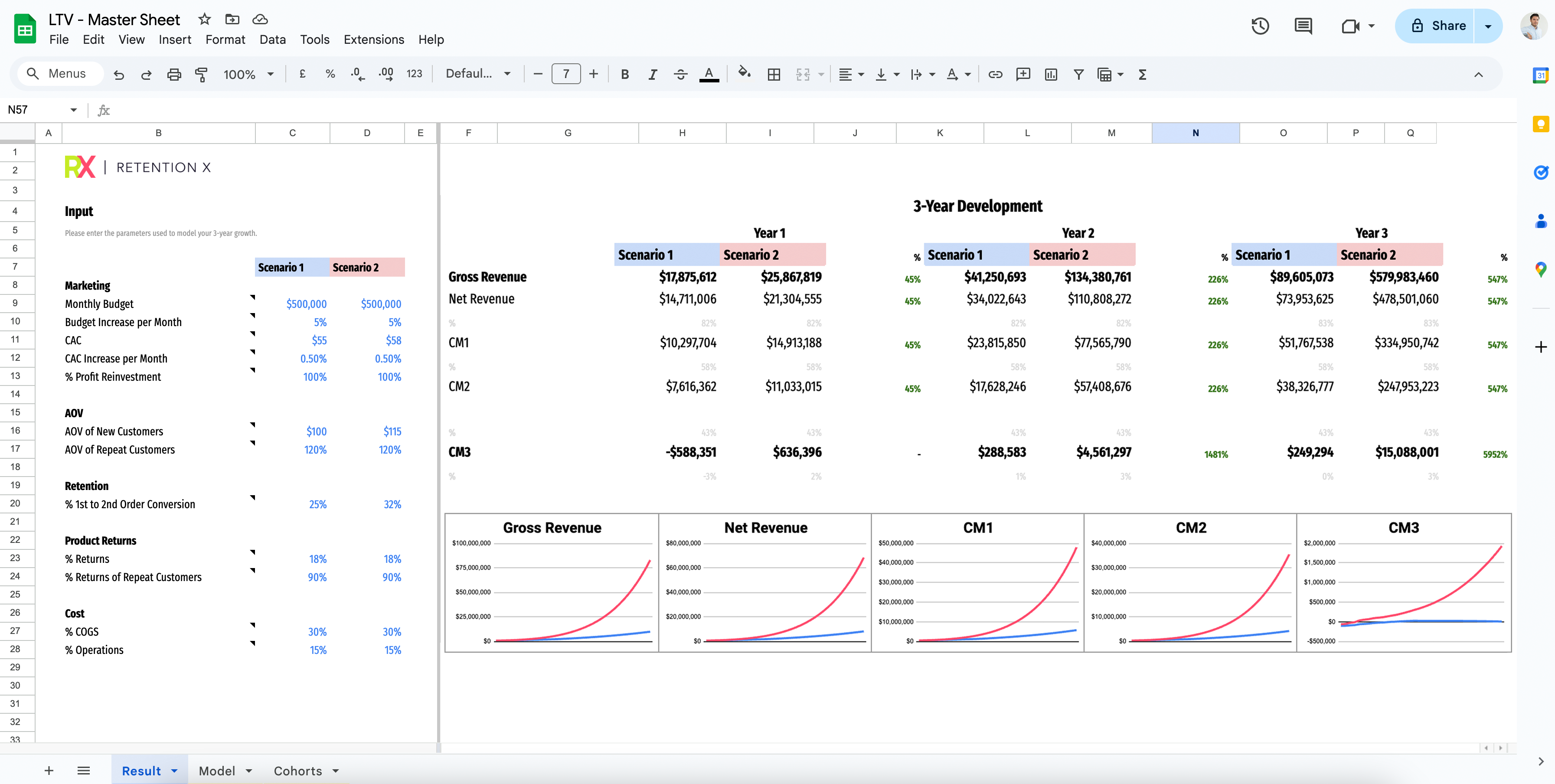

But the truth was we weren’t building sustainable growth. It felt like we were merely shifting money from one month to the next without creating real, incremental value. So I started building a simple Google spreadsheet to model what would happen if we shifted our strategy. The results were surprising: the success of our business hinged on just a handful of critical factors:

- Repeat Purchase Rate

- Average Order Value

- Product Returns

All three metrics share a common trait—they are the key drivers of the north star metric Customer Lifetime Value (LTV).

Sharing is caring: you can access the spreadsheet here. Just make a copy and plug in your own data.

Understanding the importance of LTV, I took immediate action:

- Cut Unprofitable Sales: Some customers had terrible unit economics. Their incremental revenue didn’t even cover the cost of goods sold.

- Budget Strategically:We allocated budgets to support the strategy shift, while ensuring clear visibility into how quickly the investment would pay off.

- Focus on Profit Drivers: We redirected spending toward initiatives with a direct impact on profitability.

I’ll dive into how we put these actions into practice later.

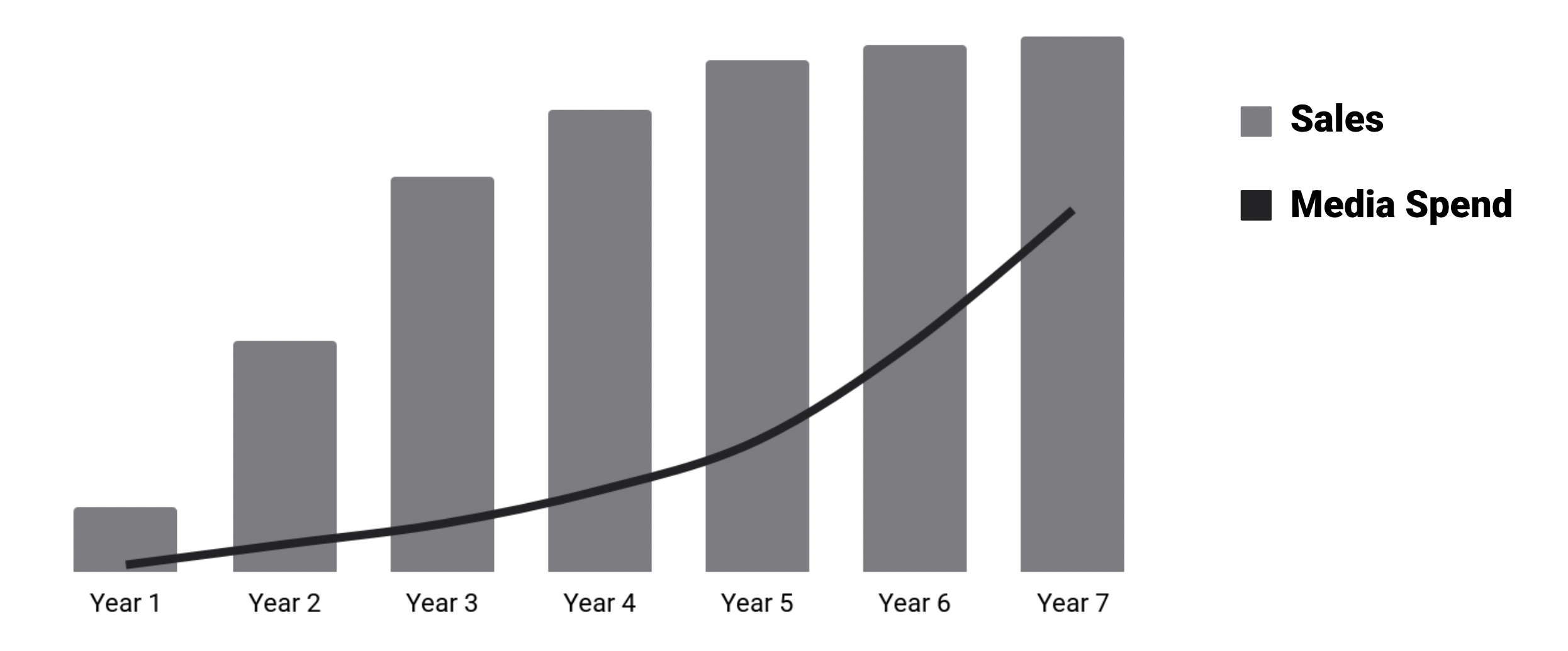

The shift in strategy didn’t just promise long-term gains—it delivered. Within 6 months, we began to see positive results. After one year, our top-line revenue was up 30%, but more importantly, our bottom-line profit had improved by 80%. By year three, the business had transformed into a completely different company!

There’s a lot of opinions about how LTV should be calculated. Different teams often push for numbers that serve their own goals. Marketers, for instance, tend to present LTV as cumulative gross revenue to justify larger budgets and higher customer acquisition costs. CFOs prefer to view LTV as net customer profit after all operational costs. Neither view serves to scale LTV.

You might wonder about factoring in shipping costs to distant countries like Japan, which are higher than those to Canada. While this is true, it’s ultimately a business decision to sell to these countries—something beyond the customer’s control. Such factors should influence your pricing strategy, rather than expecting increased loyalty from a Japanese customer to achieve the same profitability.

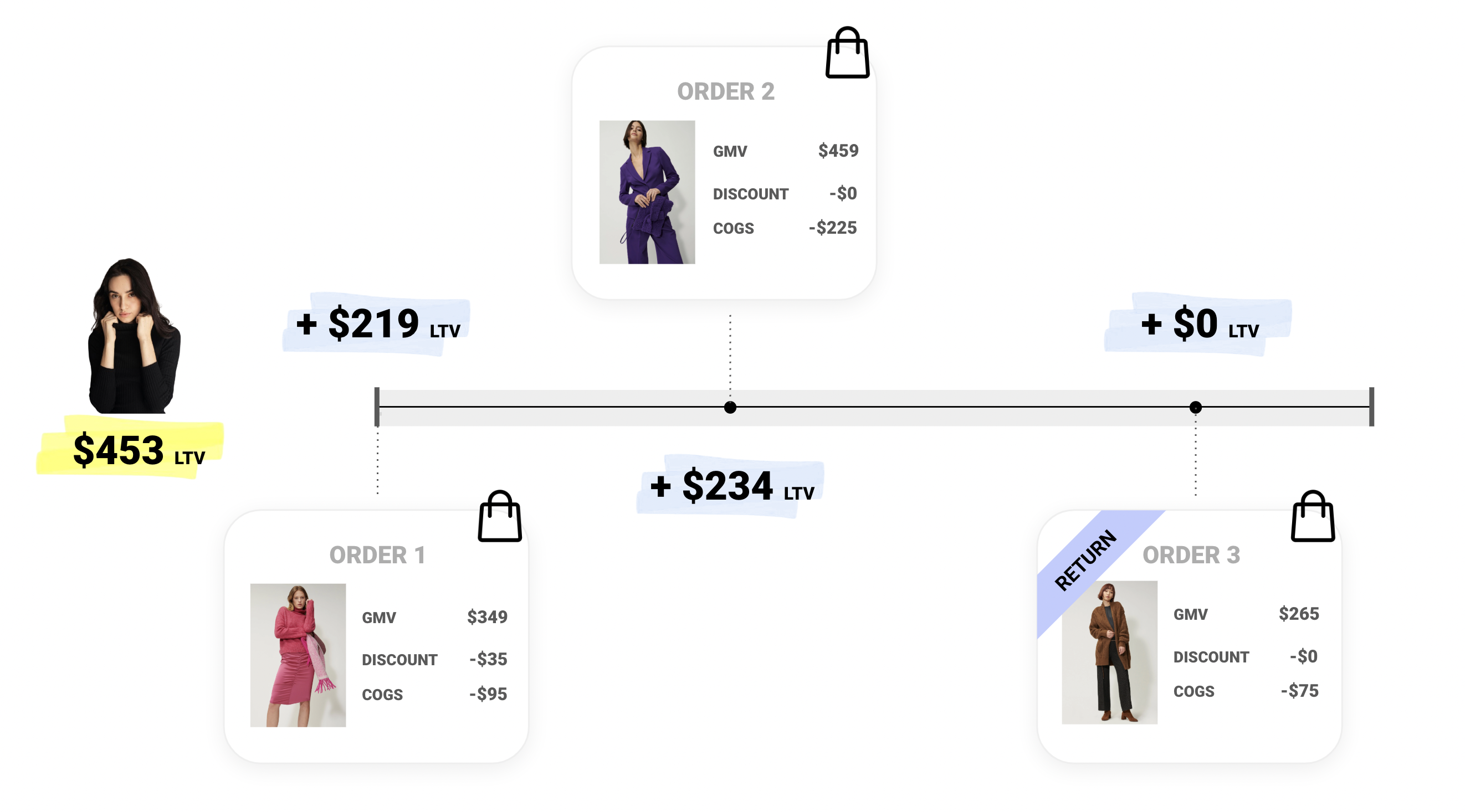

On the flip side, discounts and product returns are absolutely essential in your LTV calculation. This is why LTV should be calculated on a CM1 (Contribution Margin 1) basis.

Here’s how to calculate LTV, step by step:

- Gross Merchandise Value (after sales taxes) This is the total of a customer’s order values over time, excluding taxes. It increases with the customer’s average order value (AOV) and the total number of purchases made.

- DiscountsDeduct any discounts the customer received, including welcome coupon codes, reactivation discounts, or any other markdowns. This is the amount the customer actually paid after discounts.

- Product Returns Especially for fashion brands, product returns are a critical factor. A customer with 10 orders and a 90% return rate will cost you far more than a customer who places just one order with no returns. Returns create additional overhead—from shipping costs to handling and restocking, not to mention the impact on marketing spend.

- Cost of Goods Sold (COGS) The true value of a customer is only evident after accounting for COGS, which includes production costs or the item’s purchase price. COGS are crucial for expressing gross margins, especially when discounts are applied to orders. As discounts reduce revenue while COGS remain unchanged, the gross margin decreases, significantly impacting LTV.

The resulting value is the profit per customer over their lifetime: the LTV.

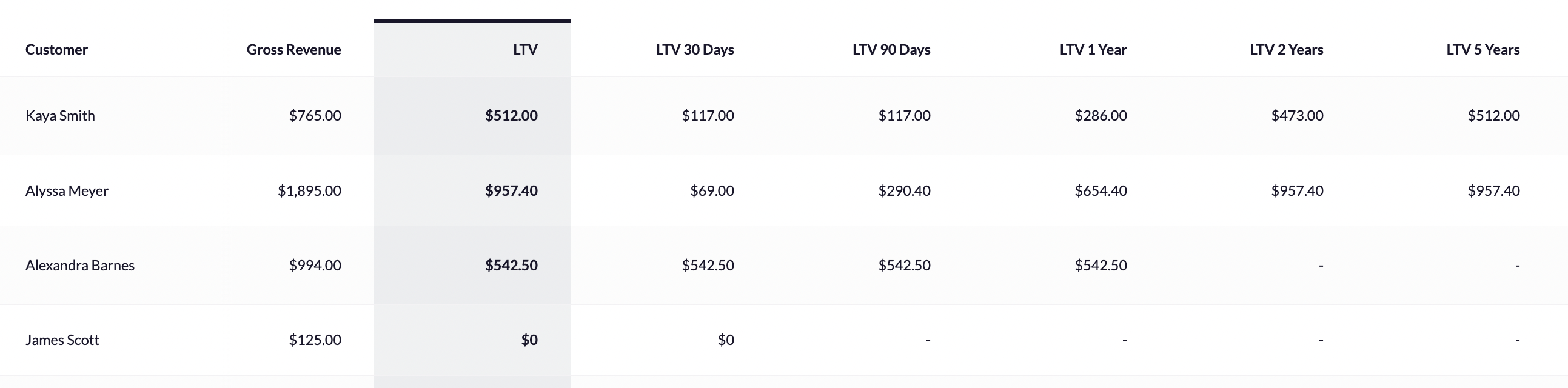

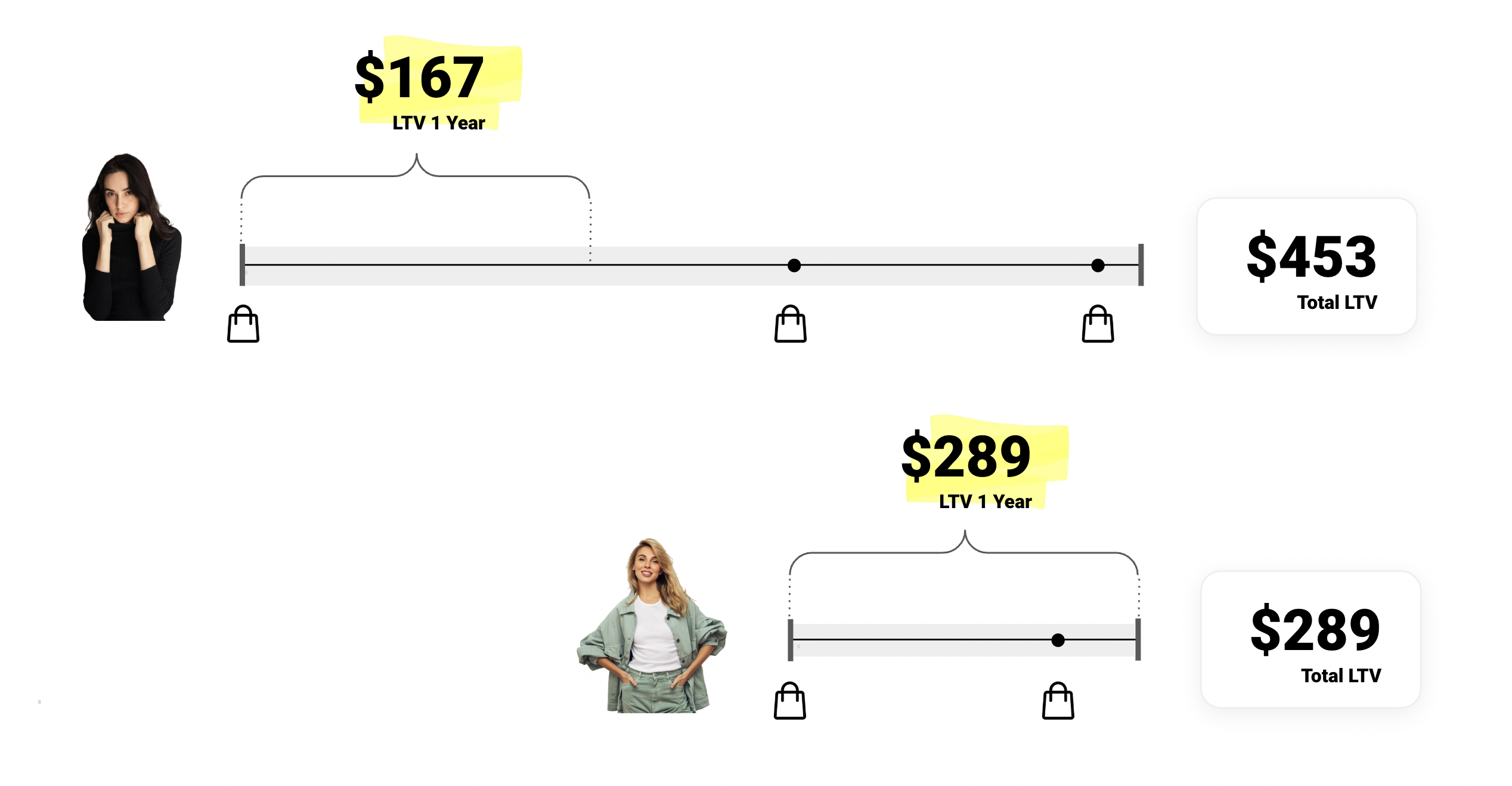

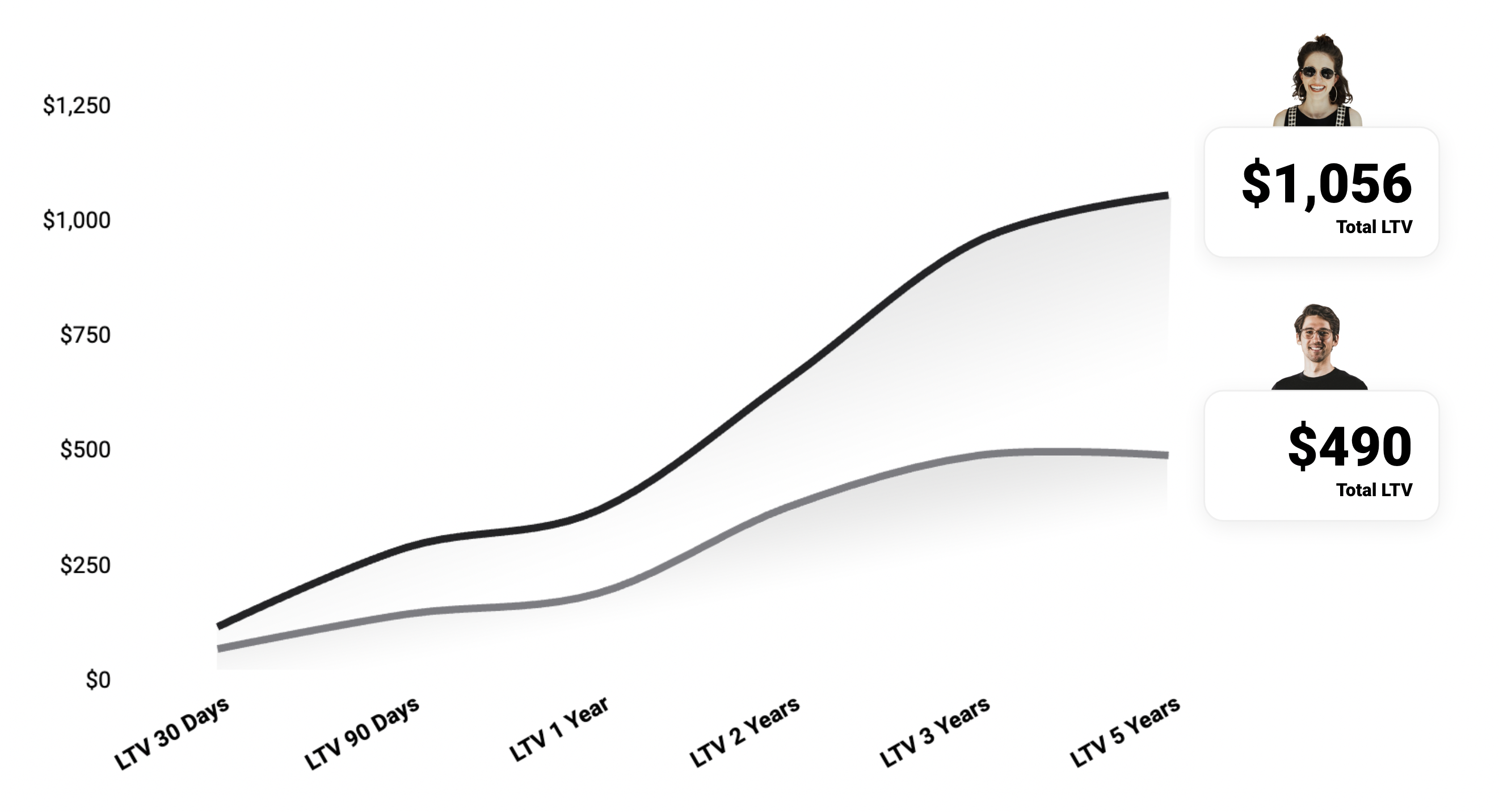

Another important factor when discussing LTV is time! Brands are often asked, "What is your LTV? This simple sounding question should never be answered with a single number. LTV is time-dependent! Because there's an inherent time component to the calculation and its tendency to evolve over time, context is key. A correct answer to this question would be something like, "After the first year, the average LTV of our customers is $250.

Why? Customers acquired a year ago had much more time to build up high LTVs than new customers from this month. To create fair conditions, you need to base the calculation on a period that all the customers included have completed.

By simply averaging all of your customers' individual LTVs, you would be giving the LTVs of new customers the same weight as those of loyal customers, which would likely lower your overall number - especially during scaling periods when you're acquiring a high volume of new customers.

Time frames used by consumer brands to measure LTV are typically 1, 3, 12, 24, and 60 months.

Okay, so now we know what to look for. But why are we doing this, and what is the expected result?

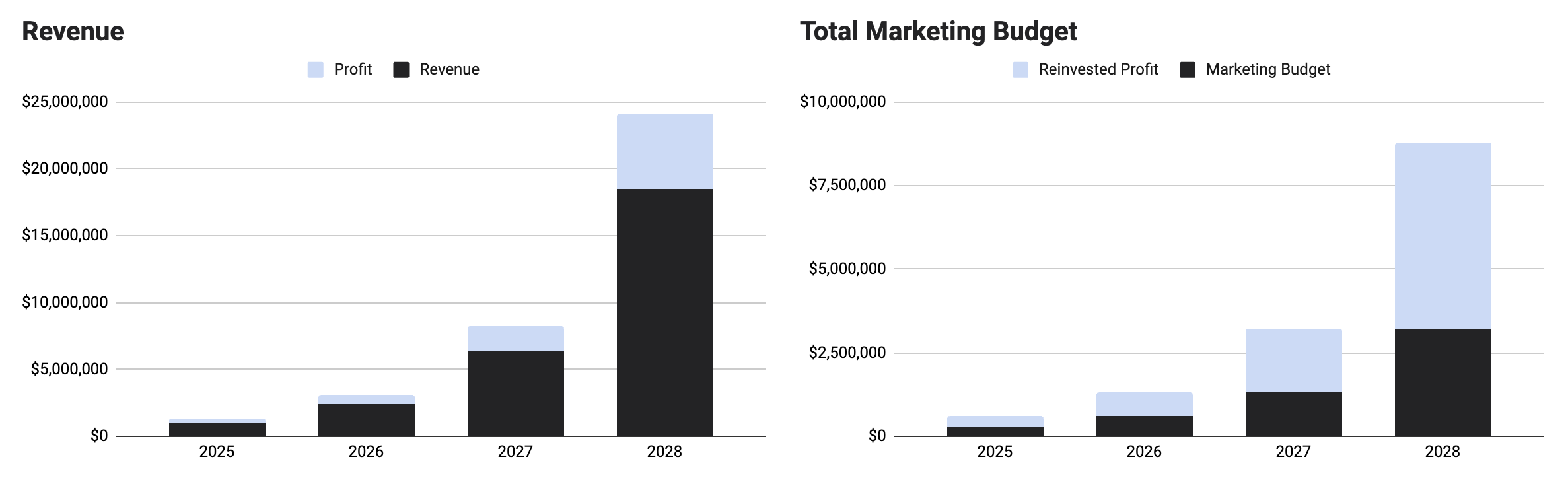

It’s simple: increasing your LTV by just 10% can result in 50% more net profit. This additional profit can be reinvested directly into faster growth, creating a compounding effect. Successful brands leverage this dynamic to scale even faster—they earn more per customer and use that extra cash to fuel further expansion.

At the same time, improving LTV reduces operational costs across the board. Serving fewer but higher-quality customers means less strain on customer service teams and fewer product returns. It allows your service team to focus on higher-value activities—like upselling or building stronger relationships with premium customers—instead of dealing with issues like fraud and chargebacks.

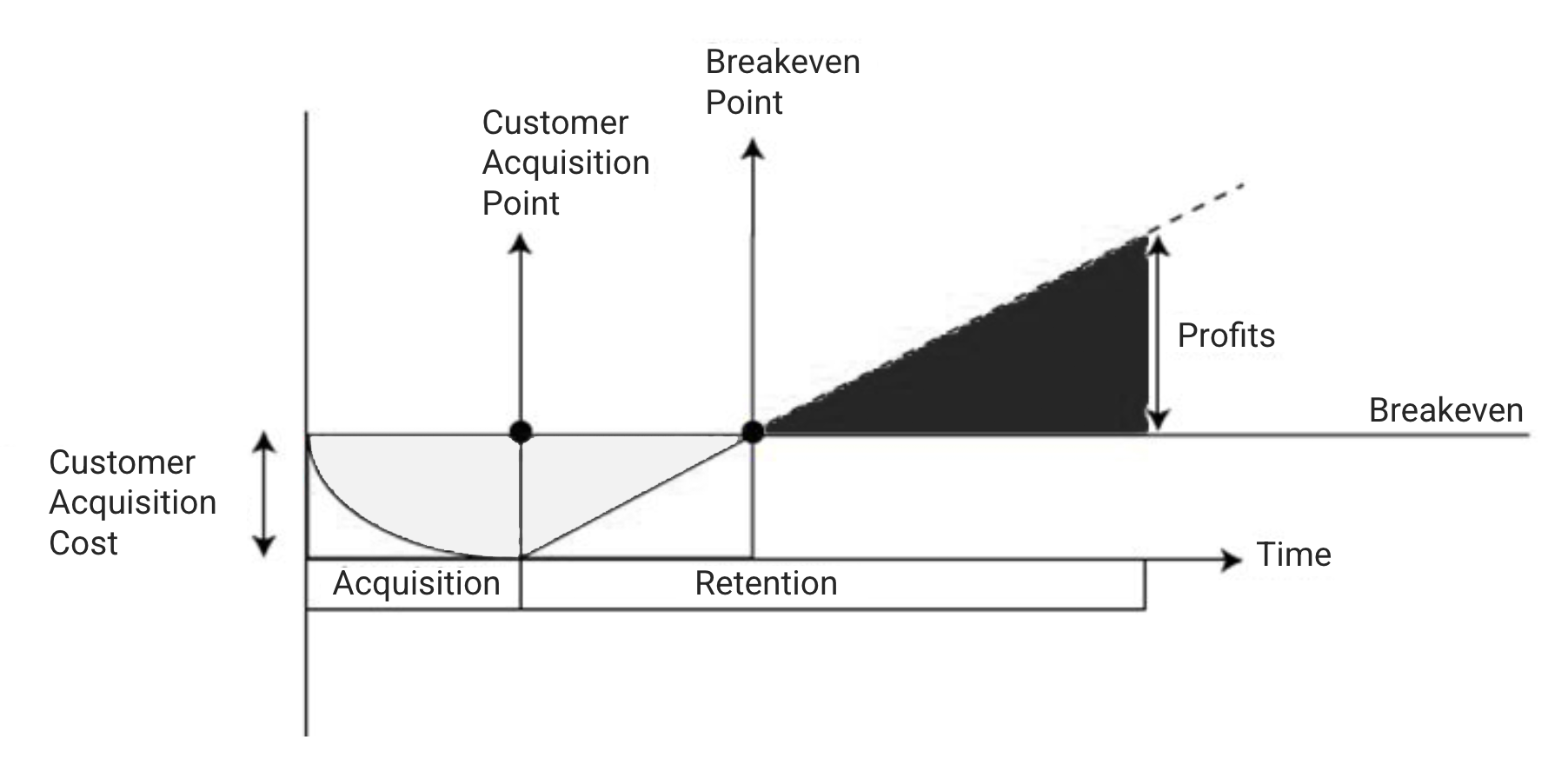

Success hinges on achieving the right balance between acquiring new customers and maximizing their lifetime value. A crucial metric that helps assess this balance is the LTV:CAC ratio—a key indicator of the efficiency and sustainability of a brand's growth strategy.

The LTV:CAC ratio compares the value a customer generates during their lifetime to the cost of acquiring them. Let’s break it down:

- Customer Lifetime Value (LTV): The profit a customer generates over their lifetime. This factors in purchase frequency, average order value, customer retention rate, and associated costs.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer, including marketing, advertising, and other related expenses.

This ratio provides a clear insight into your business’s acquisition efficiency and retention strategy. Here’s how to interpret different outcomes:

- Ratio < 1.0: If the ratio is less than 1.0, the cost of acquiring customers exceeds their lifetime value. This signals a need to reevaluate acquisition channels, optimize marketing, or improve retention efforts.

- Ratio = 1.0: A ratio of 1.0 means LTV equals CAC. While this might seem balanced, it’s insufficient for long-term growth. Aim for a ratio higher than 1.0 to ensure profitability and scalability.

- Ratio > 1.0: A ratio greater than 1.0 indicates that LTV exceeds CAC. This is a strong sign of efficient acquisition and retention, contributing to sustainable growth and profitability.

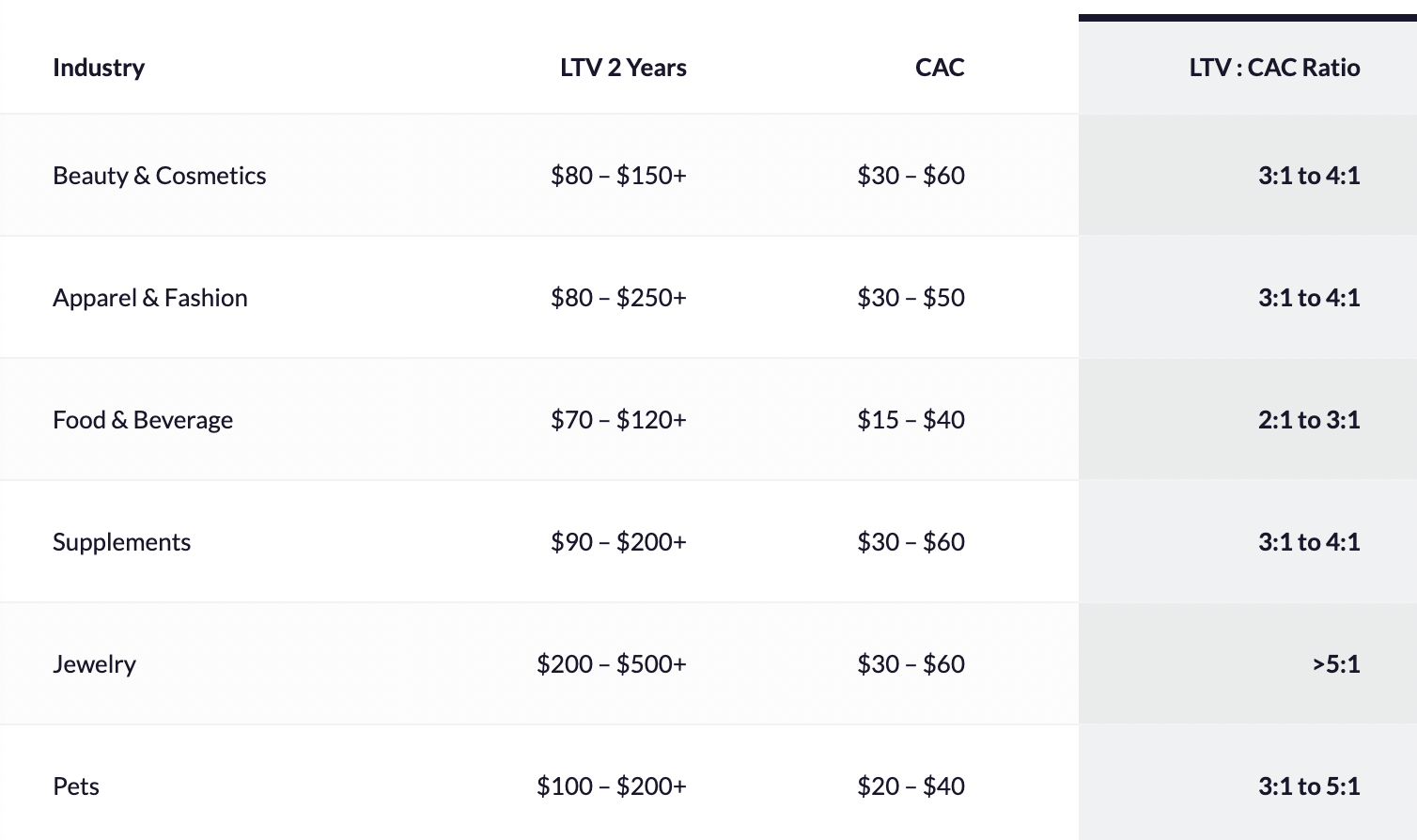

The ideal LTV:CAC ratio varies by industry and business model, but most successful brands aim for at least 3:1 within two years. This means the lifetime value of a customer should be three times the cost of acquiring them. Achieving this ratio provides plenty of room for reinvestment, innovation, and scalable growth.

LTV and CAC can vary significantly based on factors such as AOV, retention rate, and the competitive landscape within your industry. However, one constant remains—repeat customers are every brand’s secret weapon:

- 20% higher AOV than first-time buyers.

- 10% lower return rate, reducing operational costs.

- Twice as likely to repurchase, driving incremental growth.

Enough theory! Let's get hands-on and start optimizing your metrics for success.

Is LTV predetermined by your business model, or can you actively influence it? If so, how?

There are two approaches:

- Change Customer Behavior This is more challenging but focuses on encouraging customers to make more frequent or higher-value purchases or remain loyal for longer.

- Change Customer Structure This is simpler and consistently effective. By altering the ratio of high-quality to low-quality customers within your customer base, you naturally improve overall LTV—without needing to modify individual customer behavior.

I’ve compiled a list of actions that directly impact LTV, clustered by each key driver:

Change Customer Behavior

More Items per Basket

There are numerous proven tactics to increase the number of products per shopping cart. Here are some detailed guides on how to achieve this:

Higher Item Value per Basket

The most common issue, especially for more established brands, is the lack of a clear pricing strategy for bestseller positioning. The bestseller is typically the most prominently advertised product for customer acquisition. However, few brands consider where this product fits within the overall pricing structure. Often, the bestseller is priced significantly lower than other products in the portfolio. Many brands make the mistake of assuming that loss leaders are the key to reducing customer acquisition costs. However, this is usually a mistake. While it may improve CAC in the short term, it overlooks the long-term impact on LTV. I've written a full article on this effect here.

Better Repeat Purchase Rate

The overall repeat purchase rate highly depends on how many new customers make a second purchase. In particular for apparel brands, it’s important to understand that a product exchange does not count as a second purchase—swap order recognition is essential. So, what strategies can help encourage the second purchase? I’ve identified three key factors:

-

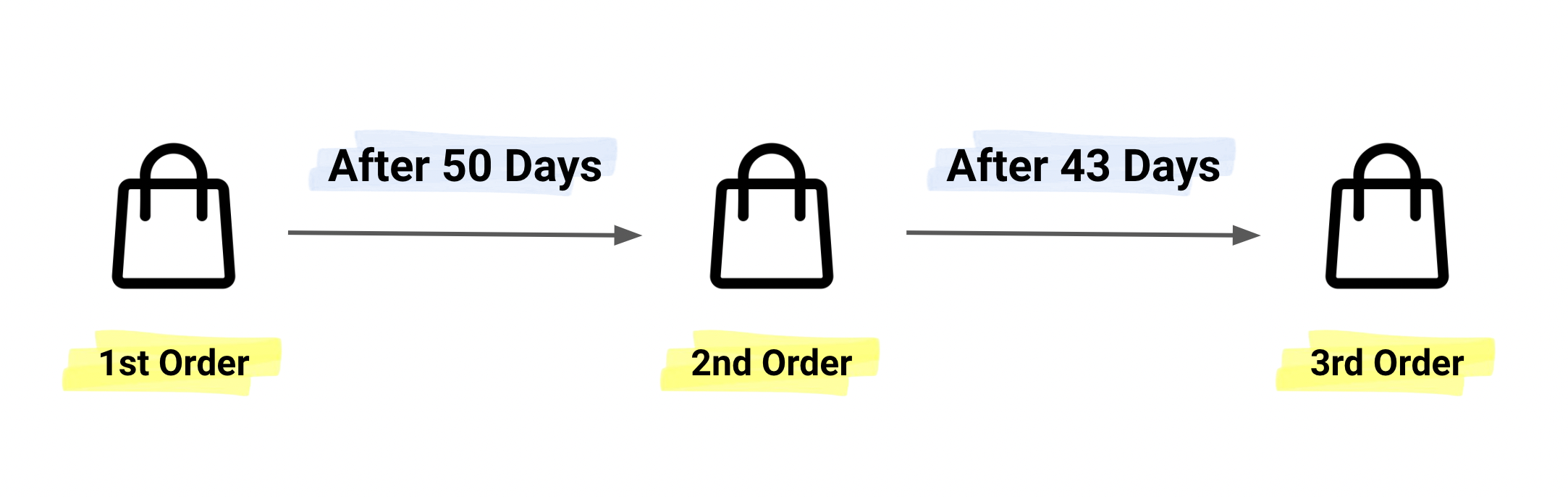

Timing: It's crucial to find the ideal time to reach out, tailored to the customer segment. When using incentives like coupon codes, be careful not to offer them too early, as it could prevent a full-price order. A good strategy is to analyze the median time between orders for specific products or categories.

-

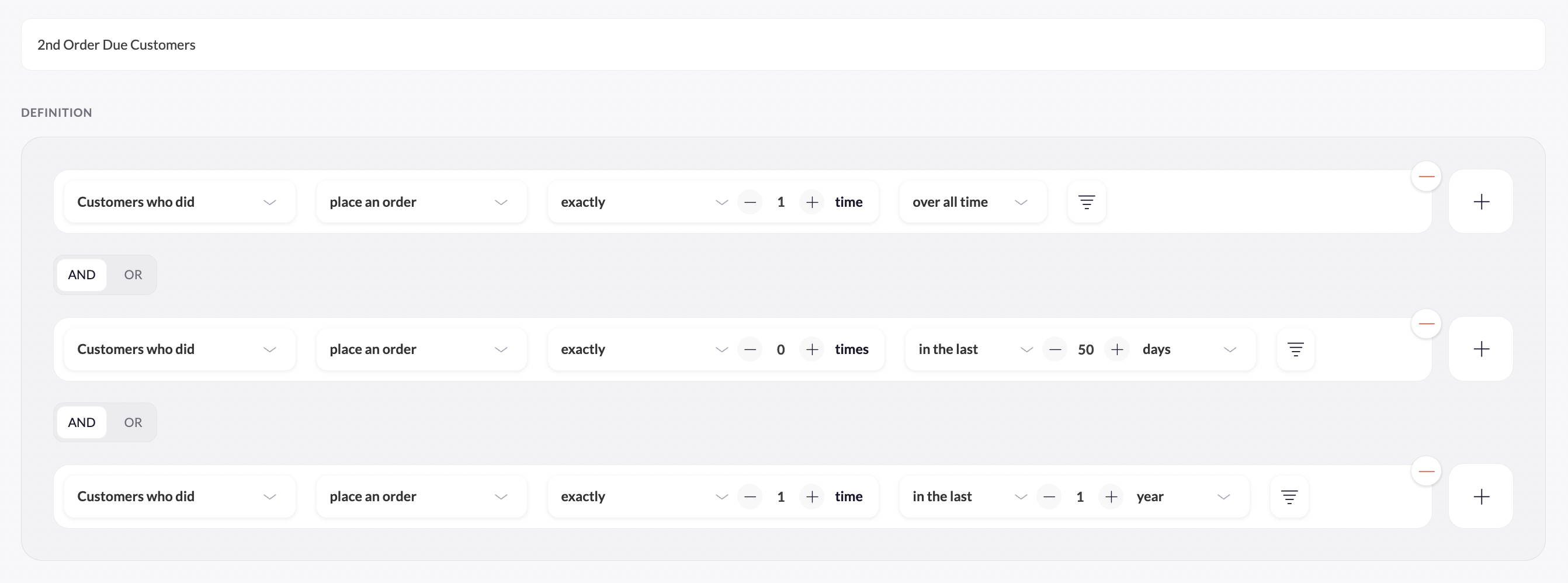

Target Group: Proper segmentation is key. Who should receive communication, and where are they in their customer journey? Are they receptive to discounts? What’s their return behavior, and what’s the typical size of their basket? The more precise you are in segmenting customers, the better you can personalize communications and content. Striking the right balance between personalization and operational efficiency is critical.

-

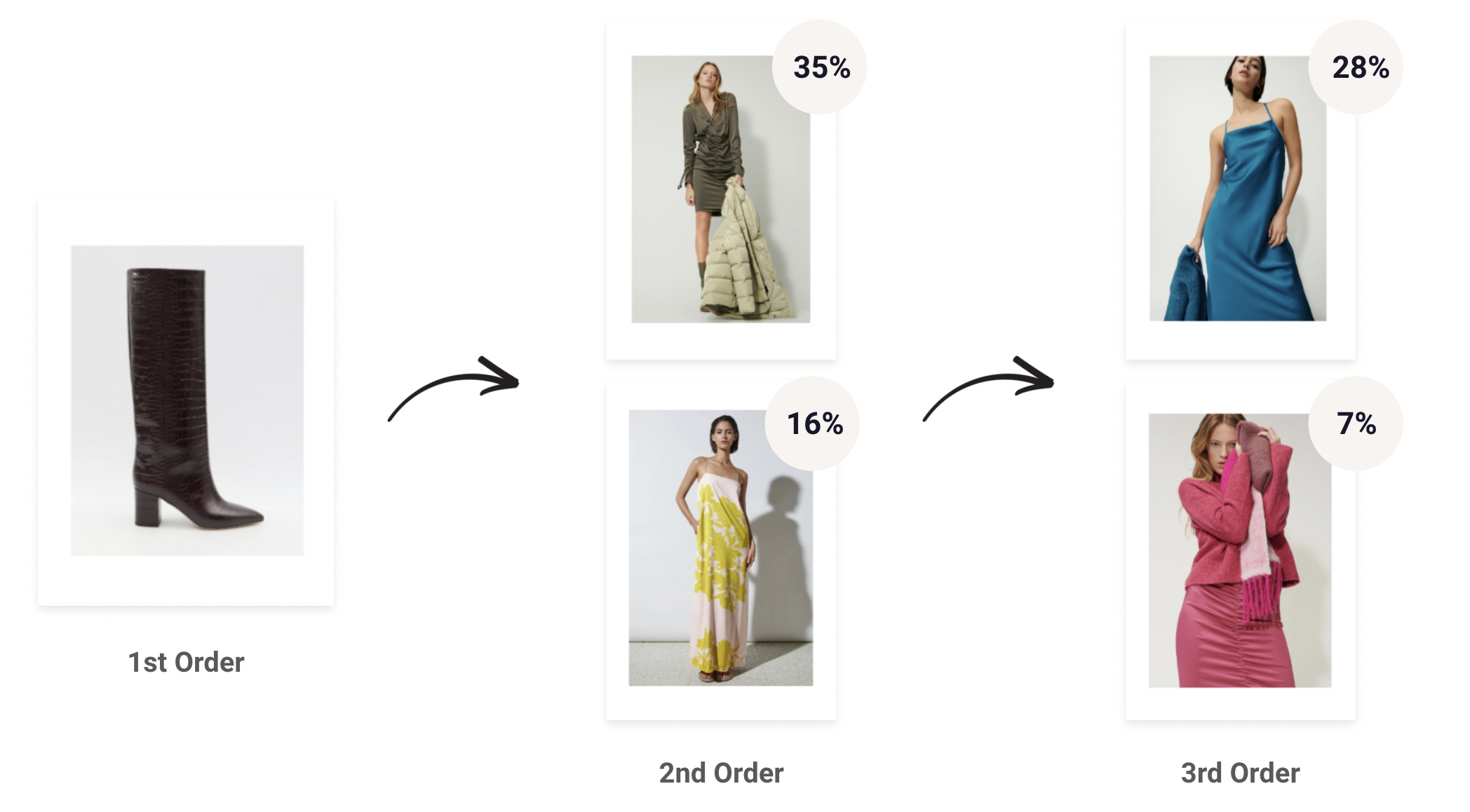

Content: Understand the ideal next best offer for the second purchase based on previous buying behavior. By analyzing repeat purchases, you can discover what customers tend to buy in their second purchase after purchasing specific products in their first.

Reduce Discounts

To maximize profitability and avoid eroding your brand value, carefully evaluate when and how you offer discounts.

-

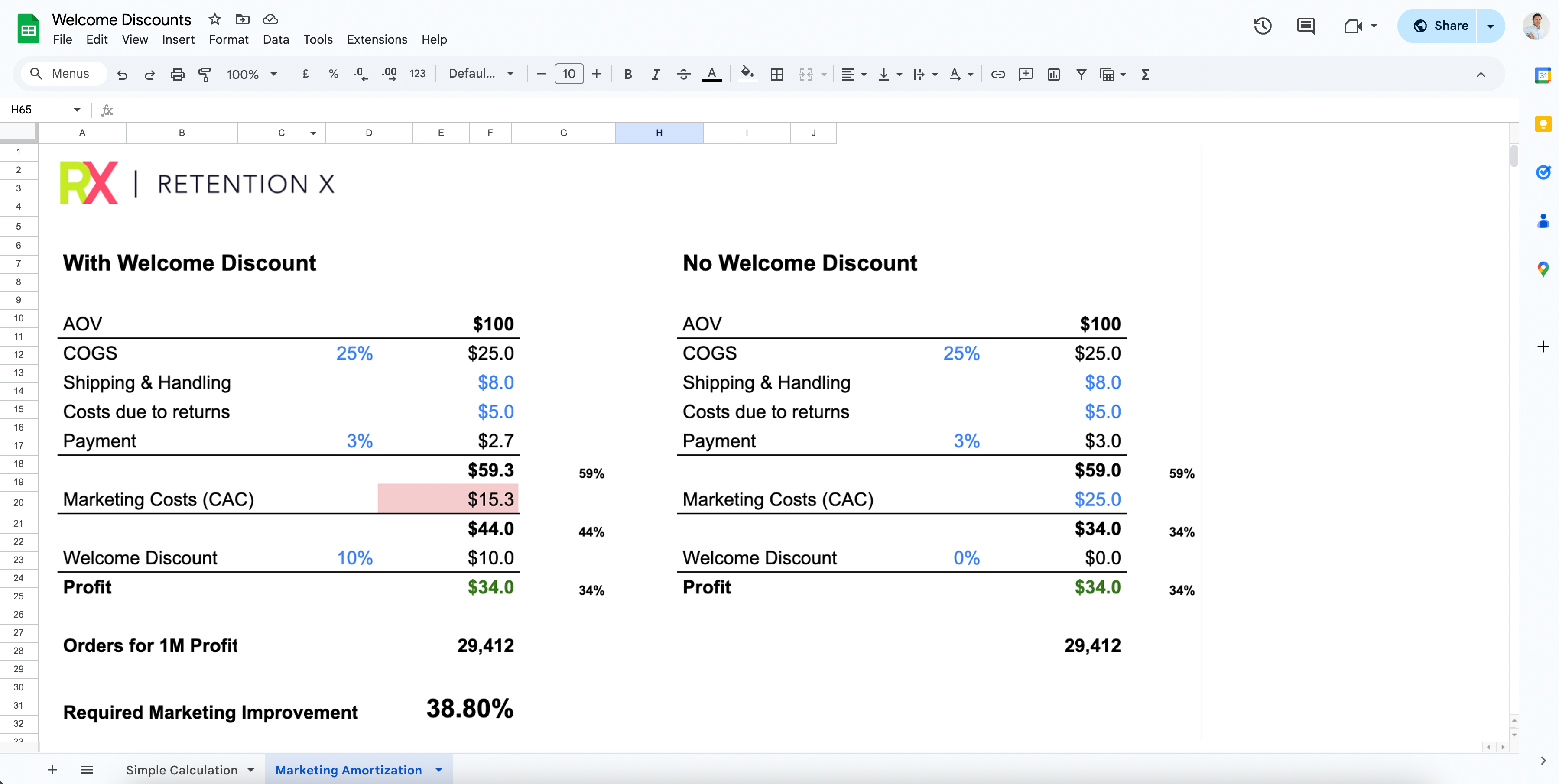

Re-evaluate Welcome Discounts: Keep in mind that offering a 10% welcome discount requires 30% more orders to achieve the same profit. Don't believe me? Read my post here and try it yourself.

- Timing of Discounts: I refer to this as the forgotten long tail. Offering discounts too early can severely impact your bottom line. If your average customer repurchases within 30 days, it's likely that 60% of customers will place their order after that period. Giving a 15% discount to all customers could have a significant negative impact on profits.

- Offer Samples: For beauty, nutrition, and health brands, offering samples can be a powerful way to introduce more products to consumers. This approach offers several benefits: it increases the likelihood of customers becoming regular buyers of a specific product line (leading to higher repeat purchases), enhances brand loyalty, and improves product penetration. Customers who receive free samples with their orders are up to 50% more likely to make repeat purchases within three months.

- Be Sensitive to Full-Price Buyers: Reduce discount and sale communications to customers who are accustomed to buying at full price. Offering discounts to these customers not only eats into profits but also dilutes the perceived value of your brand. Luxury brands have long understood this: there is a segment of customers who prefer to avoid sales and care about the prestige of the brand they wear. Many brands have suffered lasting damage to their image from aggressive outlet strategies and have spent years rebuilding their reputation.

Reduce Product Returns

Product returns are a significant cost for many brands, impacting both profits and operational efficiency. By focusing on the root causes and taking targeted actions, you can reduce returns, save money, and improve customer retention.

-

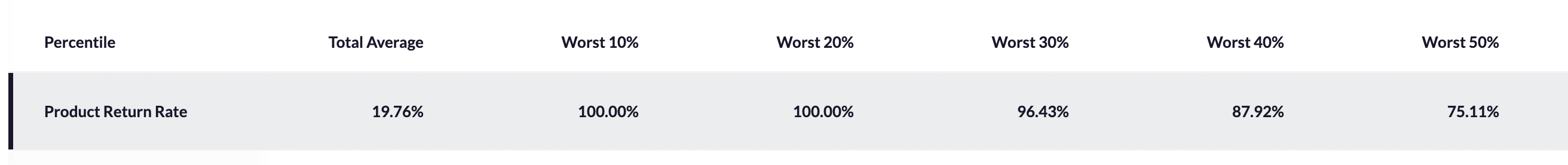

Exclude Heavy Returners: Many tips to reduce return rates overlook the most significant factor: problematic customers. US brands typically have a product return rate of 24.4% – that doesn’t mean every fourth product is returned. In fact, 80% of customers don’t return anything, 20% return everything, and 5% return occasionally. This highlights the issue with relying solely on averages rather than examining distributions.

-

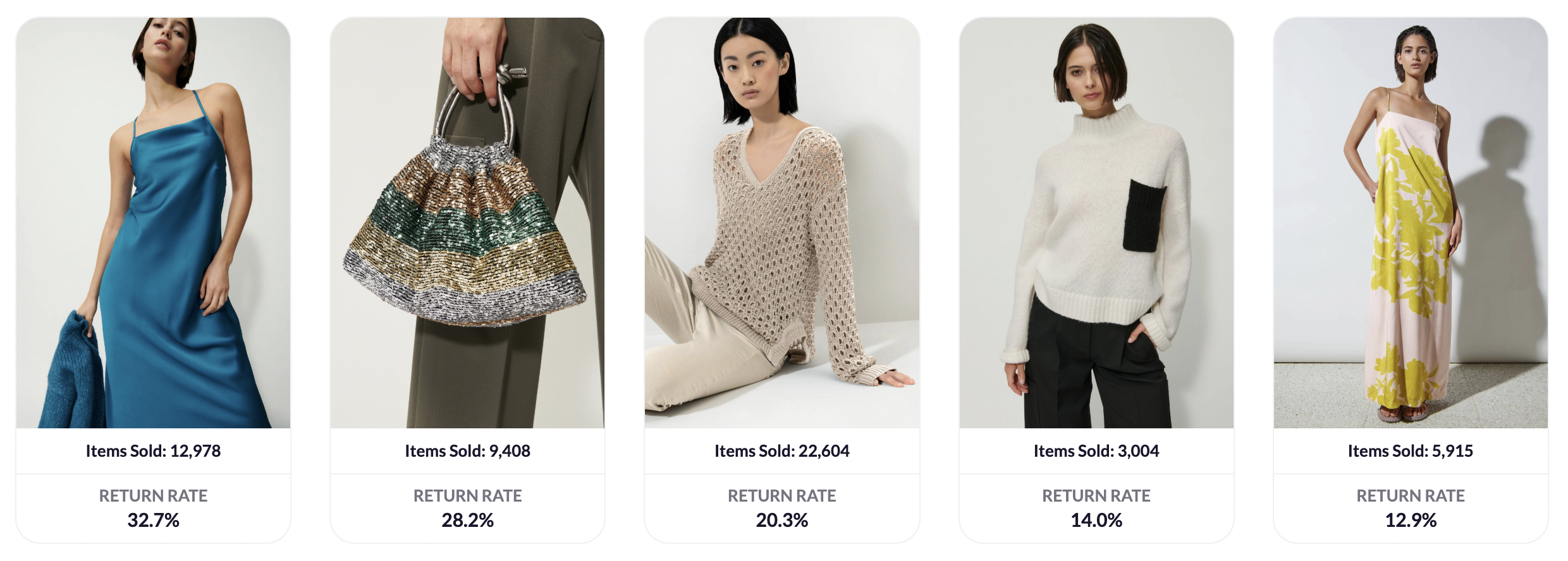

Analyze Products with High Return Rates: Stop promoting products that appear to have low customer acquisition costs but are frequently returned. This creates huge discrepancies: while your marketing team may report low acquisition costs, you’re losing substantial profits due to returns. Not only are marketing dollars wasted, but processing returns also incurs additional overhead costs.

- Encouraging Exchanges: Promoting exchanges over returns can save money and increase customer retention. Here’s how to implement this strategy effectively.

- Be Sensitive to Full-Price Buyers: Reduce discount and sale communications to customers who are accustomed to buying at full price. Offering discounts to these customers not only eats into profits but also dilutes the perceived value of your brand. Luxury brands have long understood this: there is a segment of customers who prefer to avoid sales and care about the prestige of the brand they wear. Many brands have suffered lasting damage to their image from aggressive outlet strategies and have spent years rebuilding their reputation.

Change Customer Structure

Optimizing LTV requires a deep understanding of your customer structure. Analyze key segments and adjust strategies based on specific attributes that drive higher loyalty, repeat purchases, and ultimately improve LTV.

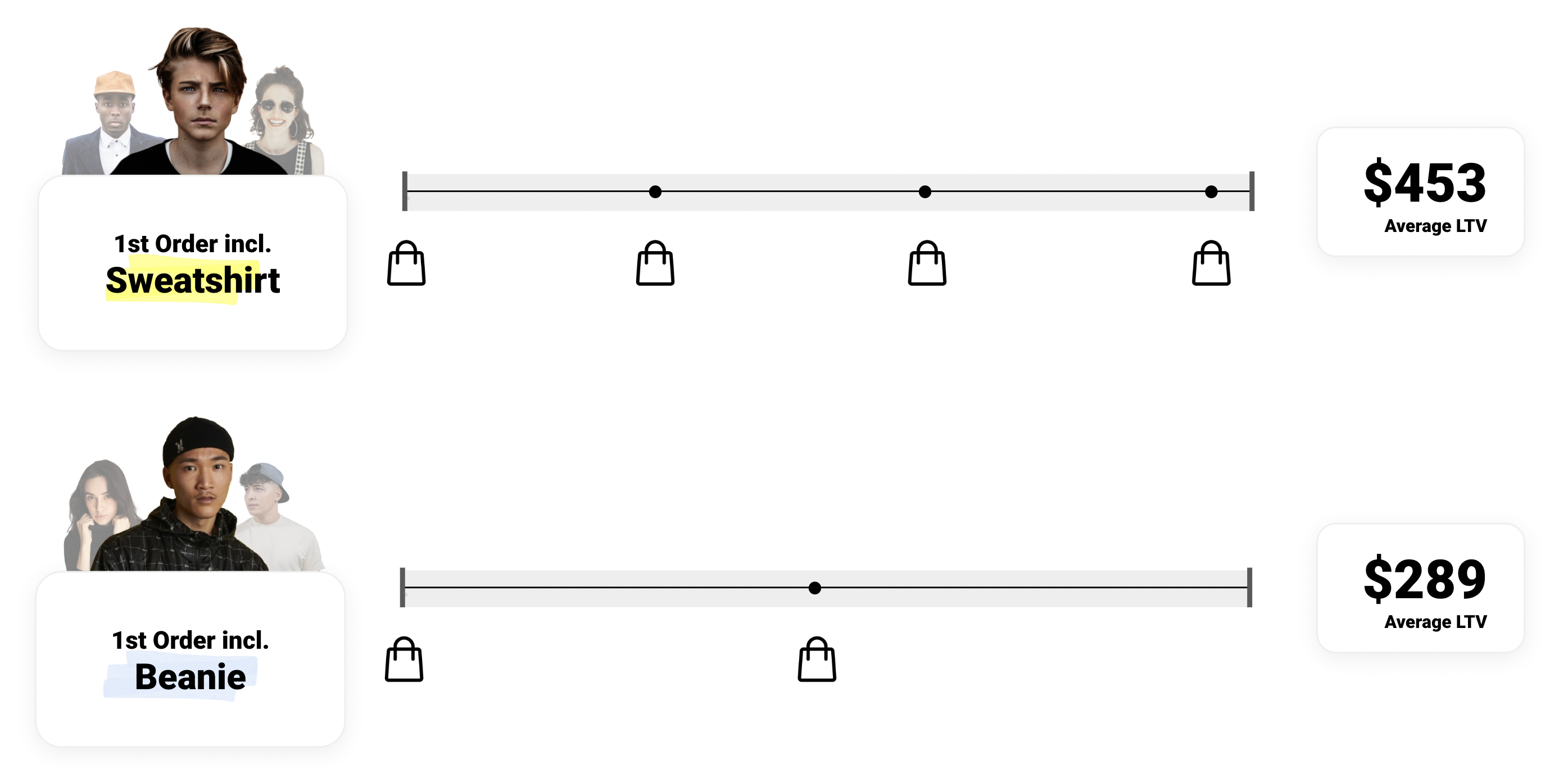

Product & Category

Every product journey is different and often defined by the first item a customer buys. Certain items lead to higher customer loyalty and repeat purchase rates, with more expensive initial products often resulting in better return rates. This highlights the importance of your pricing strategy for promoted products. If you lack product-level data, analyzing LTV by category can provide valuable insights.

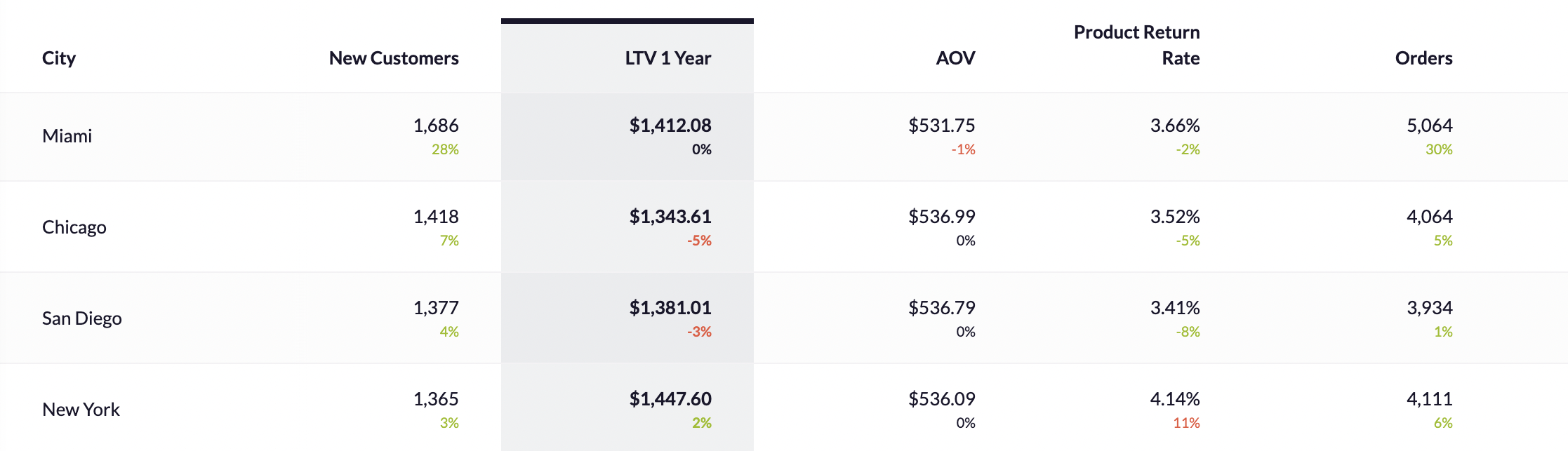

Location

There is a strong correlation between the Buying Power Index (BPI) and LTV. By identifying key cities for marketing focus, you can increase customer LTV by as much as 82%, allowing you to justify higher acquisition costs in high-value areas while cutting back on low-value cities.

Marketing Journey

Many marketing platforms, such as Meta and Google, focus on first-purchase ROAS, but overlook LTV, especially when factoring in returns and discounts. This can lead to misjudgments about the effectiveness of campaigns and channels. Some may seem less cost-effective but result in better customer quality. Optimizing solely for CAC without considering the resulting LTV is one of the top mistakes marketers make.

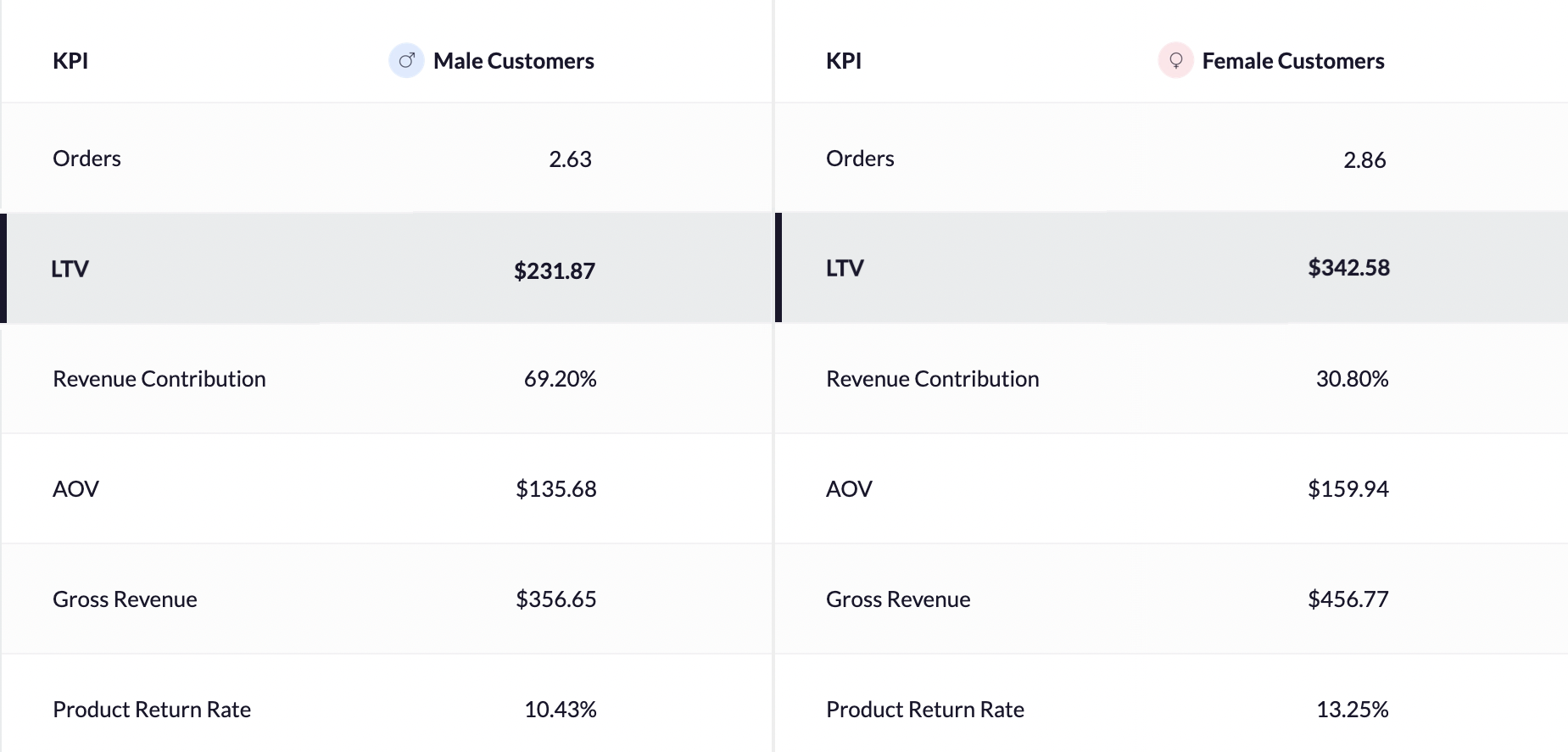

Gender

Leverage gender predictions to identify key differences in buying behavior between men and women. This data enables you to target the opposite gender during key gift-buying periods, boosting sales.

Incentives

Understanding which types of incentives—such as a percentage off vs. dollar off—best affect LTV is critical. Analyze the impact of different coupon strategies, considering factors like repeat purchases, gross margin, and the total discount given.

I know that’s a lot to take in! I’ve been in the same position—feeling overwhelmed about where to find the data, how to get started, and how to embed an LTV-driven mindset into my teams. That’s why we built RetentionX. It was my #1 internal tool as a brand operator to turn things around before launching it as publicly available software. All of the strategies above can easily be analyzed and implemented with RetentionX.